Solar Panel Financing Terms

System cost the cost of the solar system see gross system cost.

Solar panel financing terms. Many are 0 down loans and allow you to finance the total amount of your solar panel system. They have a principal amount an annual interest rate monthly payment requirements and a payback period just like any other loan. Solar loans loans specifically for solar. Solar financing financing provided to a client that needs financing specifically to move forward with solar energy.

Types of solar panel loans reamortizing a term loan. Solar loans are loans issued expressly for putting solar panels on a house. Solar loans are generally considered a subcategory of home improvement loans. During a term loan depending on your loan provider you can re amortize your loan one time for free.

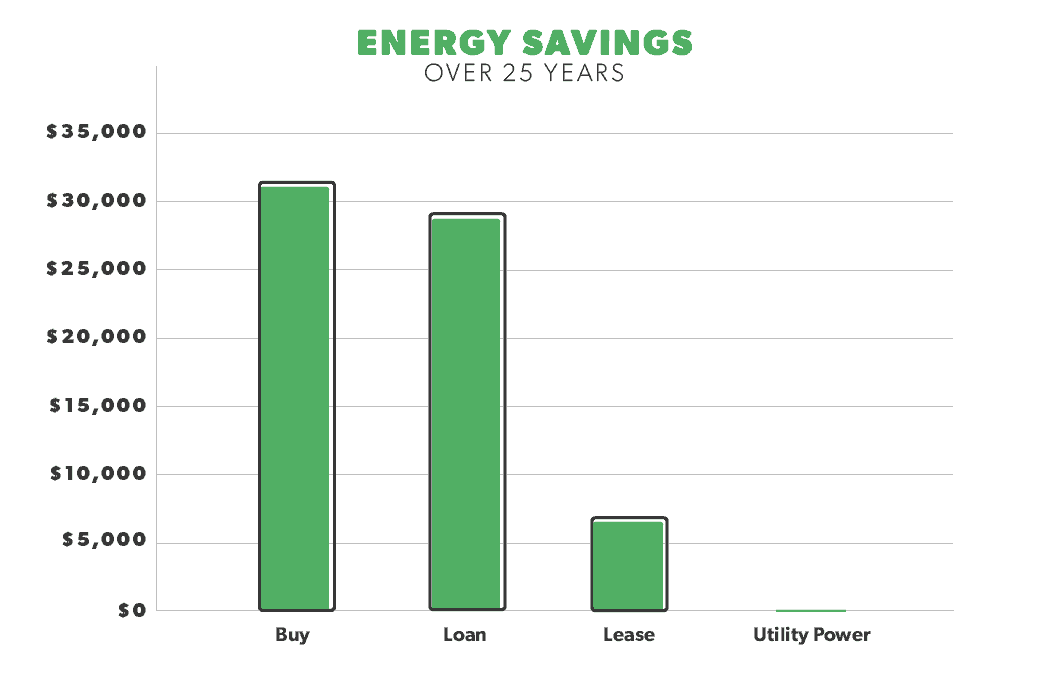

Compare solar loans and solar leases on energysage to determine which one is right for you. Both options reduce your monthly electricity bills and your impact on the environment but the terms and conditions of each type of agreement are different. For example you might see a 20 000 solar loan with a 4 5 interest rate and a fifteen year payback period. System payback another term for payback period.

Many different types of institutions offer solar loans from traditional banks to solar panel manufacturers. The bill savings can then be used towards the monthly loan. Term lease or loan the contractually agreed upon. Solar loans and solar leases each have advantages and disadvantages.

Pick my solar recommends that once you receive your tax credit you apply those savings towards re amortizing your loan.