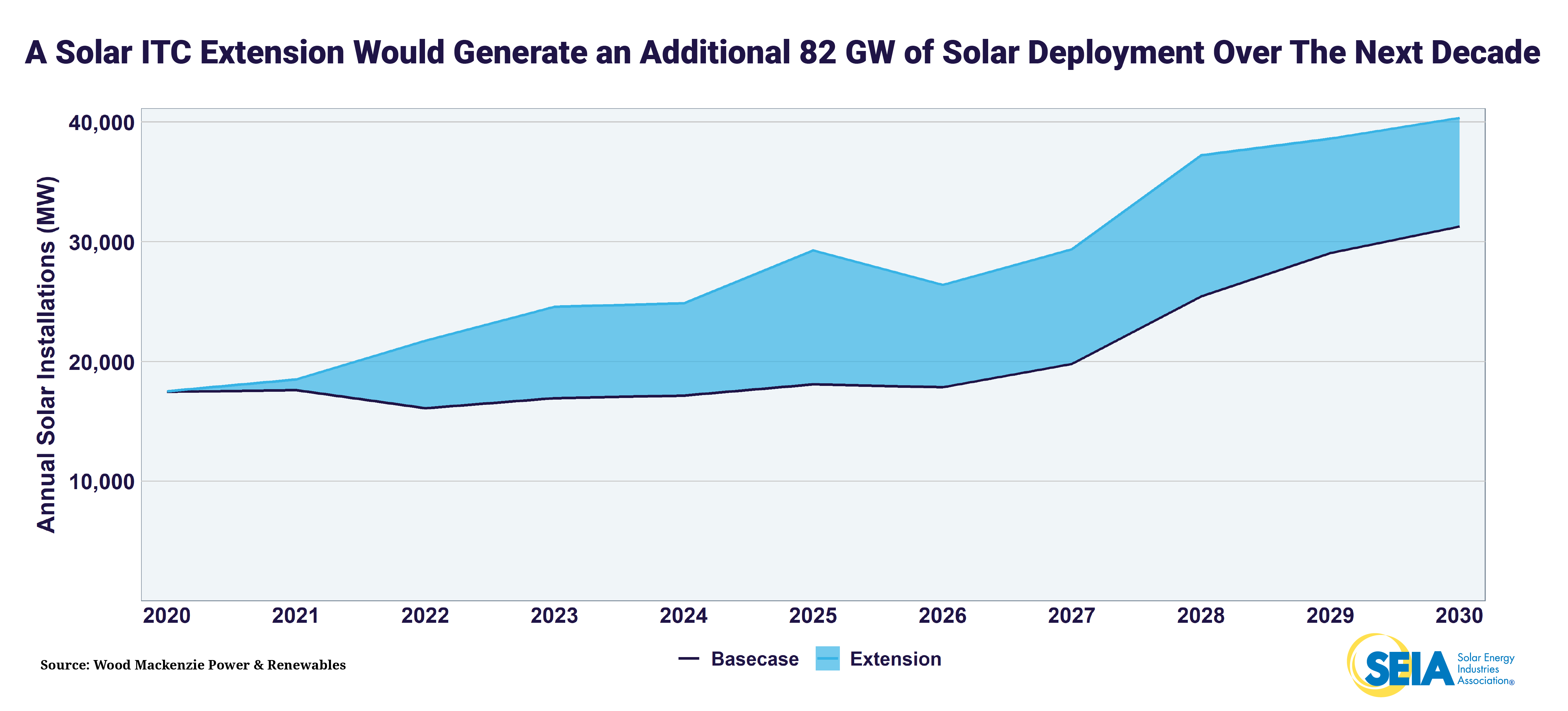

Solar Itc Phase Out Schedule

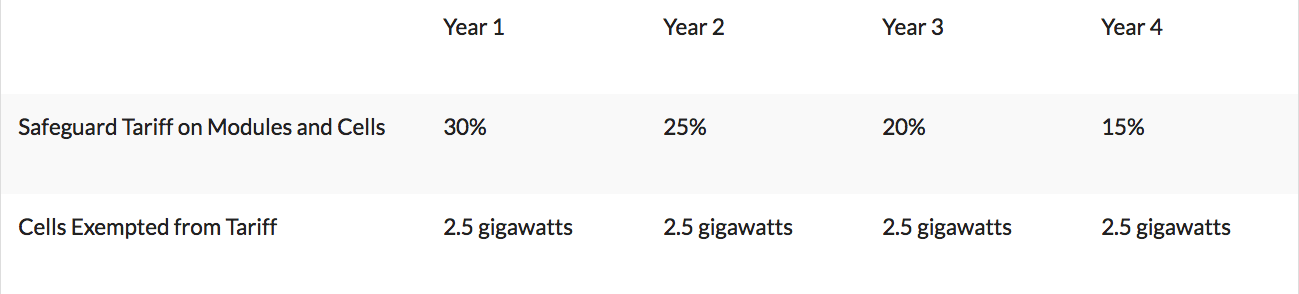

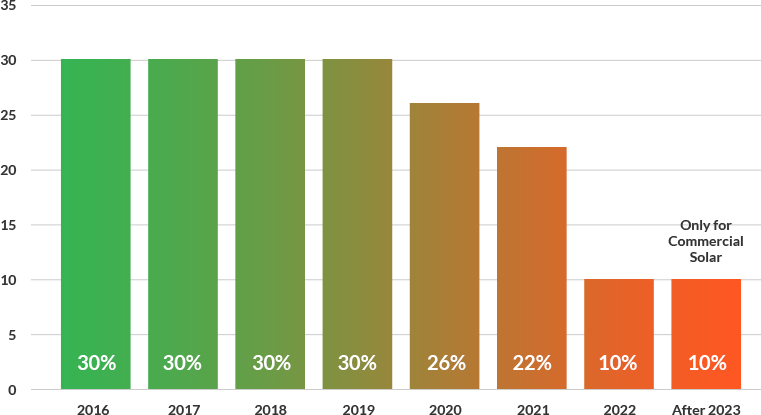

31 2016 and instead stepped down from 30 to 10 until 2024.

Solar itc phase out schedule. The itc applies to both residential and commercial systems and there is no cap on its value. Here s a quick example of the difference in credits in 2019 and 2020 for a 9 kw solar array at an average cost of 27 000. His company s research has shown that the itc s phase out schedule is expected to remain intact. As summarized by research firm ihs key details of the extension include.

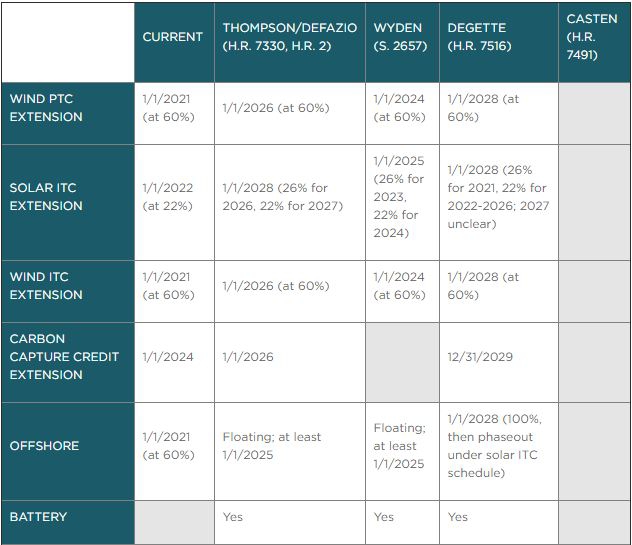

In december 2015 congress enacted a five year extension of renewable energy tax credits for solar and other renewable energy technologies as part of an omnibus spending bill. Projects that start. Since the investment tax credit is applied to your solar array s gross system cost the amount you receive is dependent on the amount of solar you re purchasing. The bipartisan budget act of 2018 modified section 48 by retroactively extending the itc for certain other renewable energy property for which construction begins before jan.

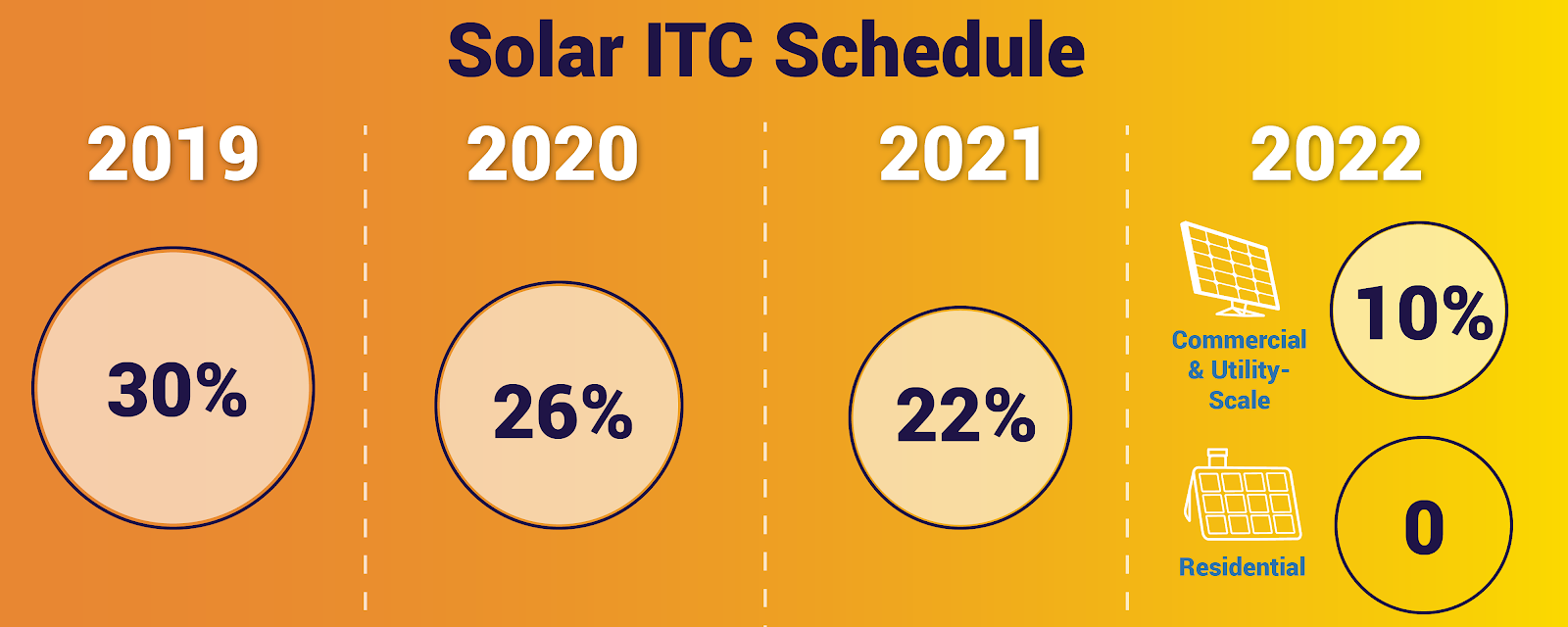

The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The itc will be extended from dec. As a result of these enacted changes the itc phase out schedule for the different types of energy property is as follows. Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

Since the itc was enacted in 2006 the u s. Economy in the. The itc and ptc extension dates back to 2015.