Solar Investment Tax Credit Phase Out

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s.

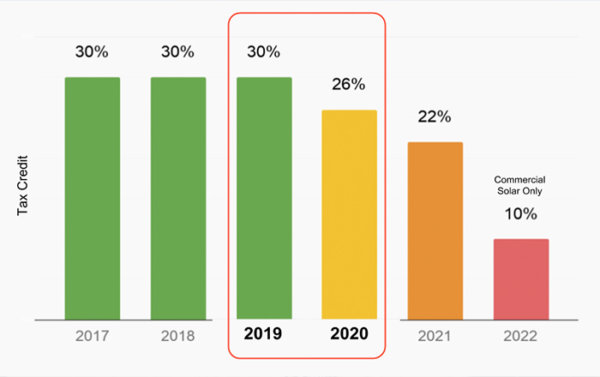

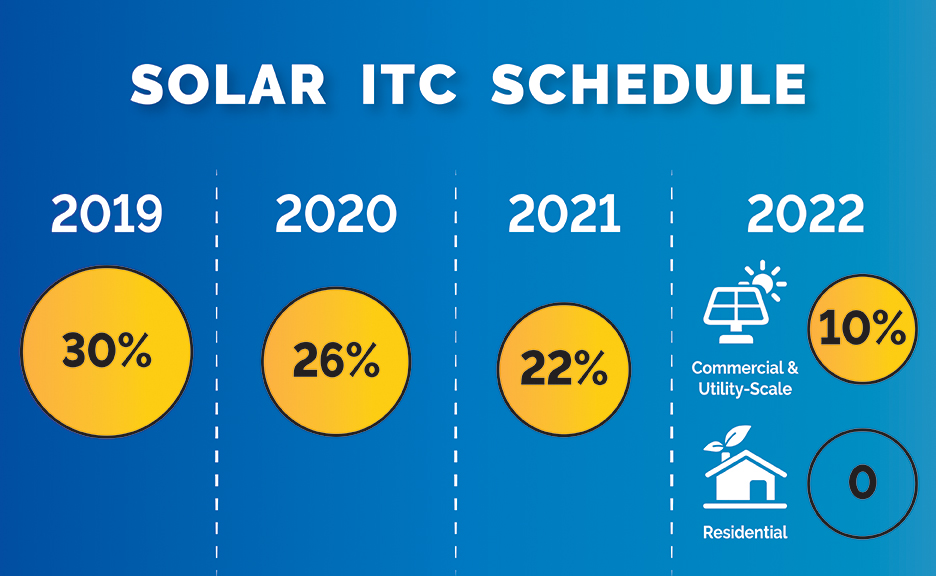

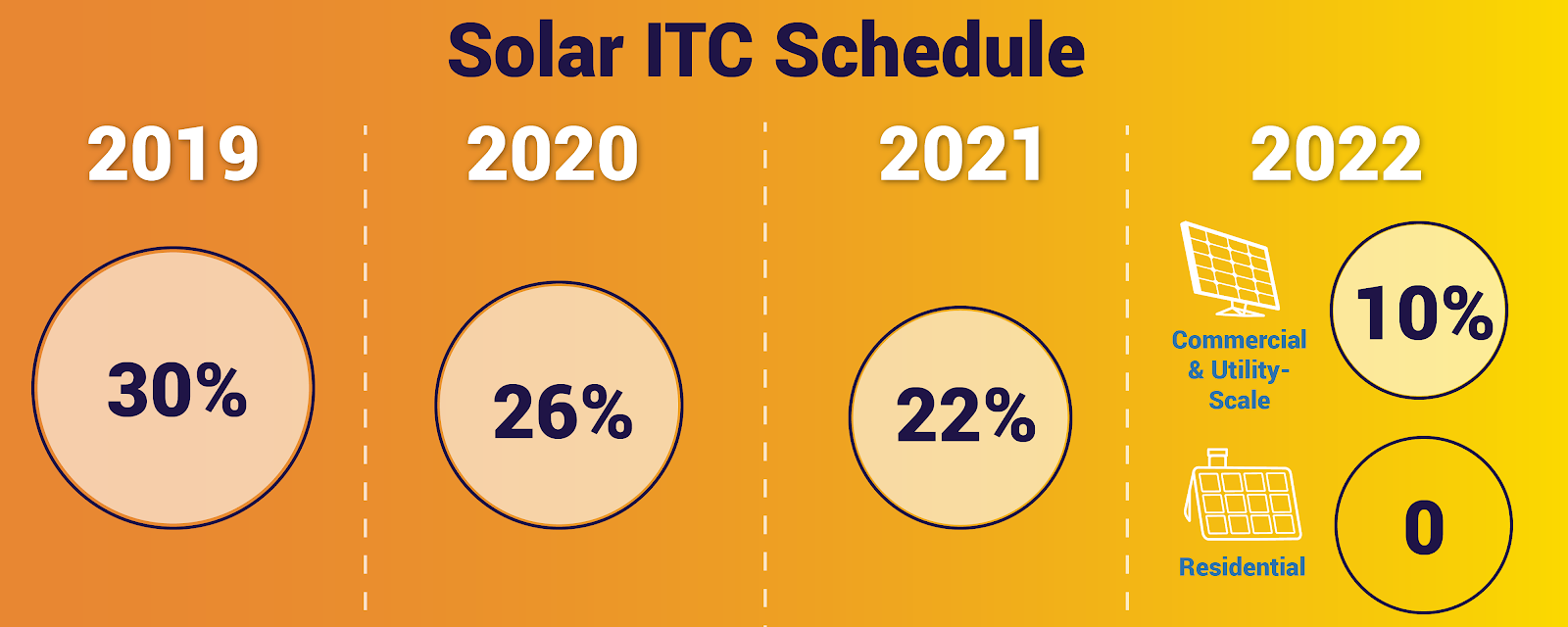

Solar investment tax credit phase out. By 2020 it ll be worth 26 then 22 in 2021. As mentioned before if it costs 10 000 to buy and install your system you would be owed a 2 600 credit. The federal solar tax credit also known as the investment tax credit itc is one of the best financial incentives for solar in the united states it allows you to deduct 26 percent of the cost of a solar energy system from your federal taxes and there s no cap on its value. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

The itc applies to both residential and commercial systems and there is no cap on its value. The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states. The itc was originally established by the energy policy act of 2005 and was set to expire at the end of 2007. The history of the solar investment tax credit.

How long is the federal solar tax credit available for use. The federal government is gradually going to phase out the solar tax credit. This includes the value of parts and contractor fees for the installation. The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing an average sized residential solar.

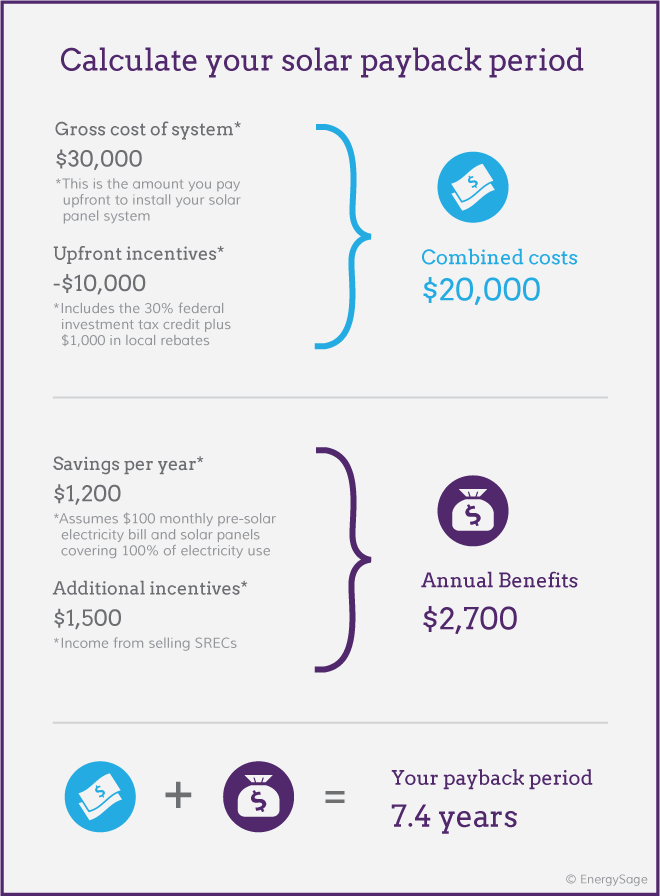

The solar investment tax. Economy in the. Bigger system bigger credit. Here s a quick example of the difference in credits in 2019 and 2020 for a 9 kw solar array at an average cost of 27 000.

Since the investment tax credit is applied to your solar array s gross system cost the amount you receive is dependent on the amount of solar you re purchasing. The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. Since the itc was enacted in 2006 the u s. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation.

Right now the solar investment tax credit itc is worth 26 of your total system cost.

_540_449_80.jpg)