Solar Investment Tax Credit Calculation

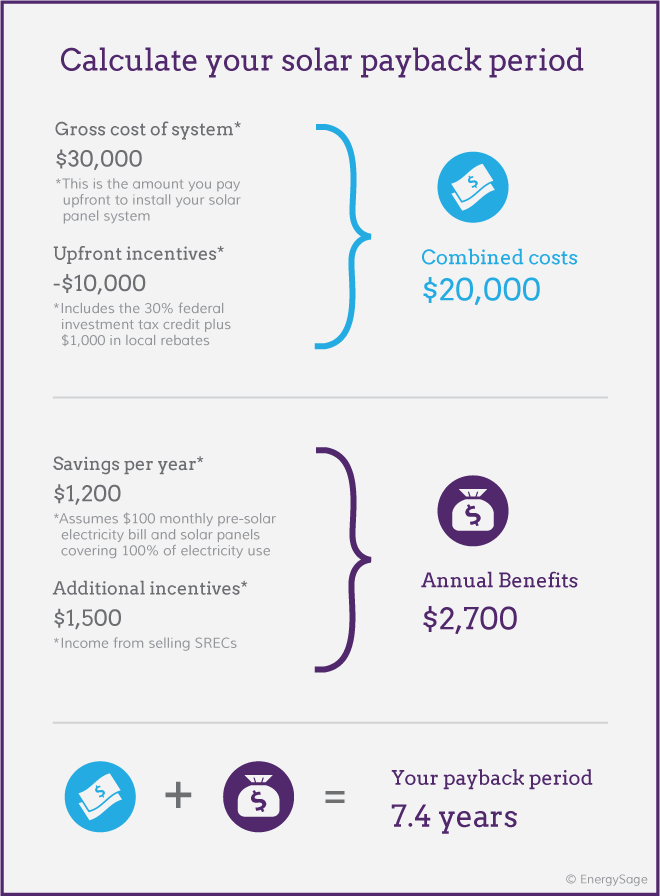

As mentioned before if it costs 10 000 to buy and install your system you would be owed a 2 600 credit.

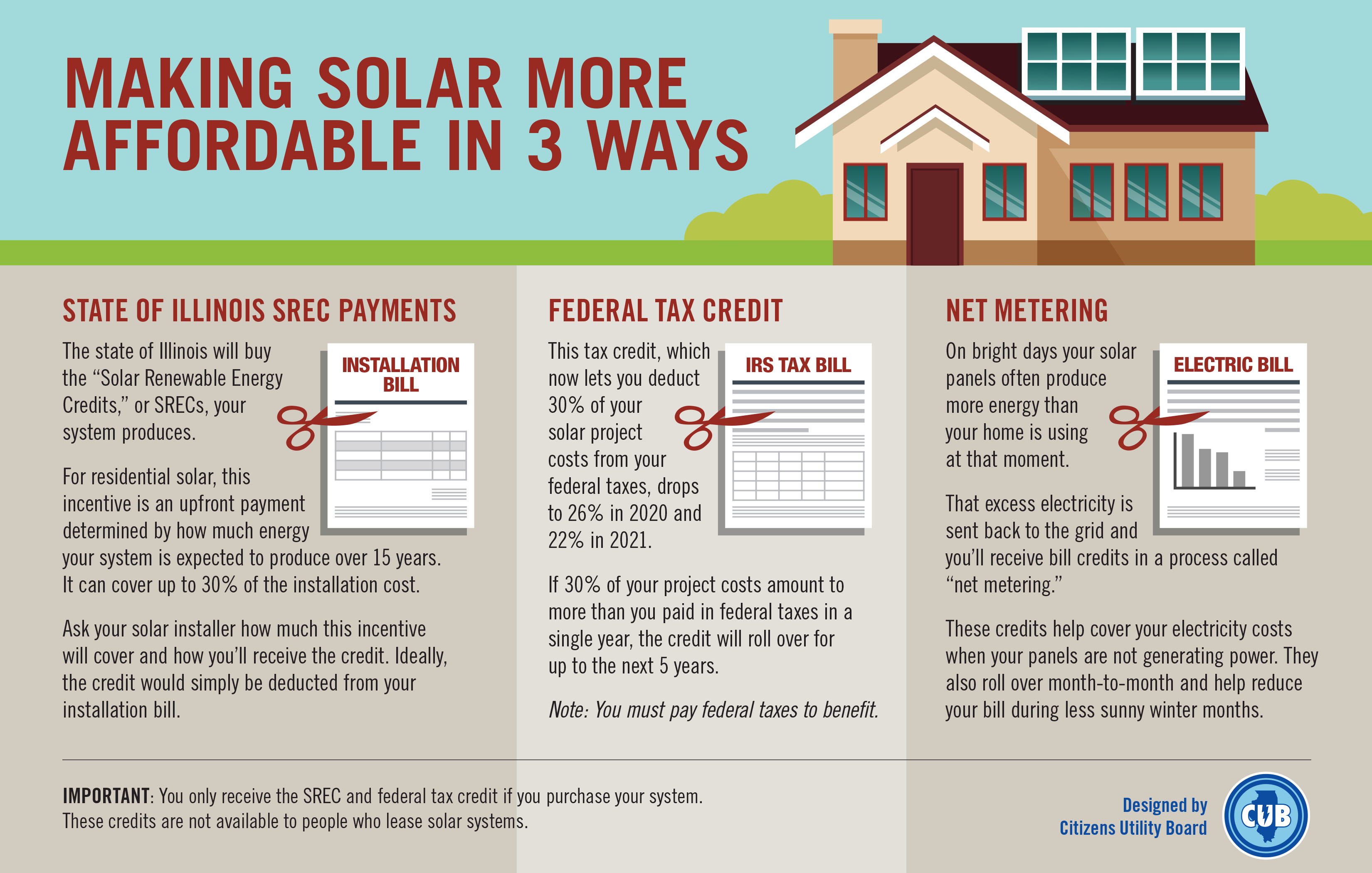

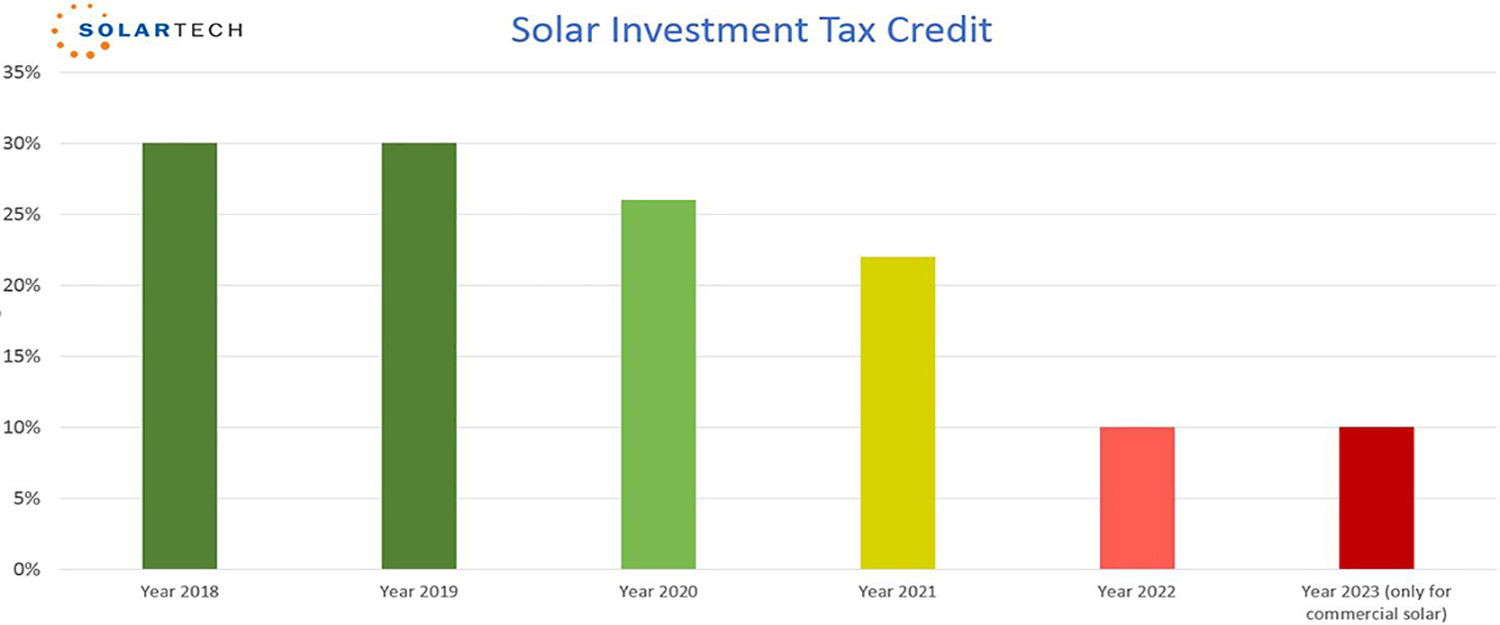

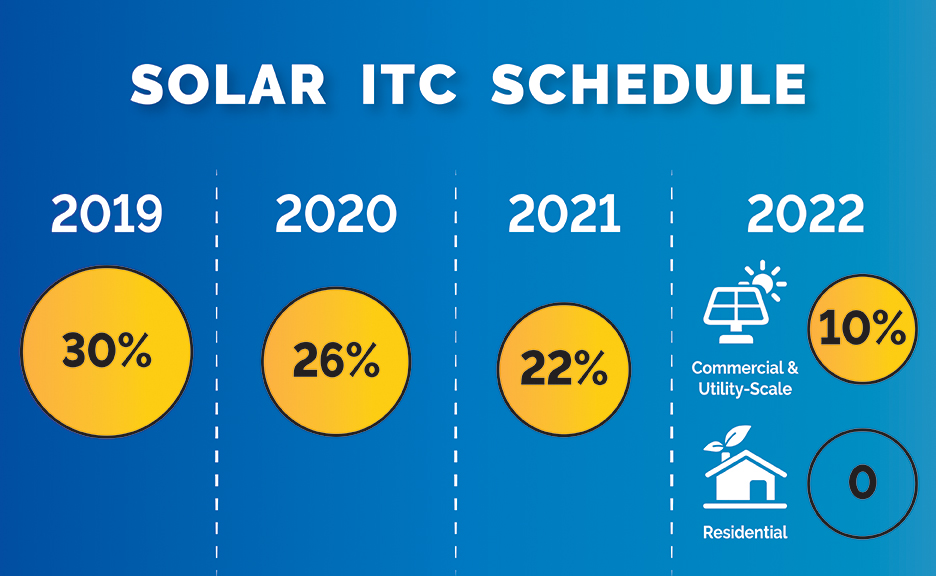

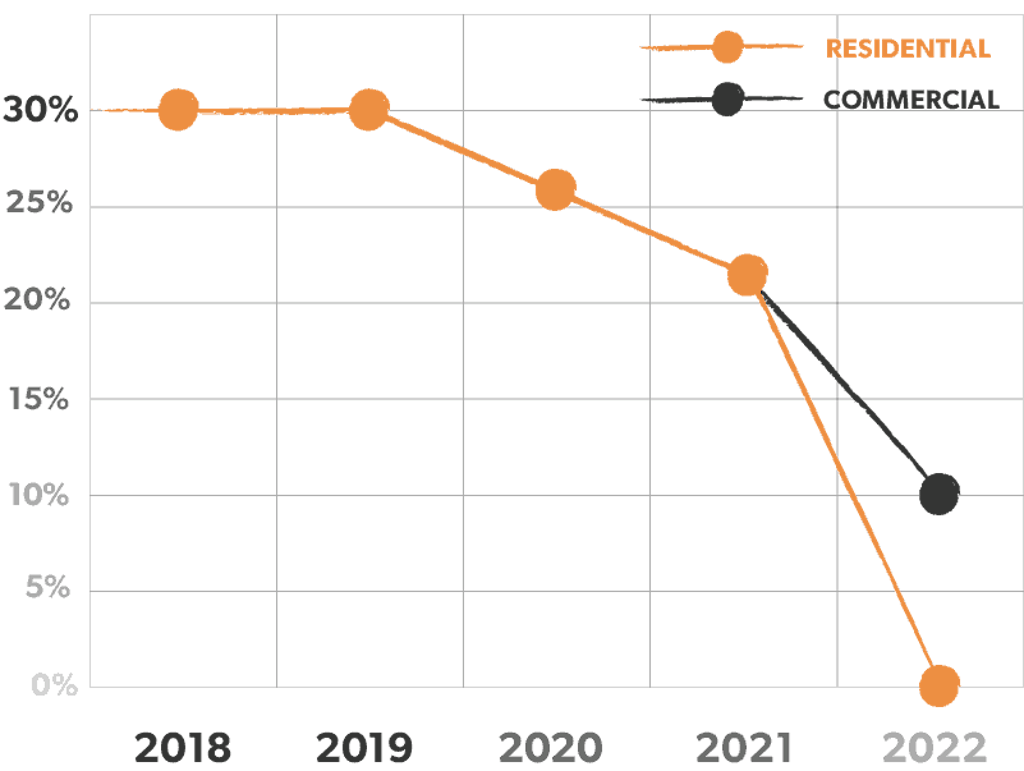

Solar investment tax credit calculation. Since the itc was enacted in 2006 the u s. Economy in the. Currently the itc is 30 of the gross system cost of your solar project. The itc applies to both residential and commercial systems and there is no cap on its value.

The itc was originally established by the energy policy act of 2005 and was set to expire at the end of 2007. However you cannot claim a tax credit if you are a renter and your landlord installs a solar system since you. How to calculate the federal solar tax credit. The federal solar tax credit is a great example of an innovative tax policy that encourages investment in 21st century energy systems and technology.

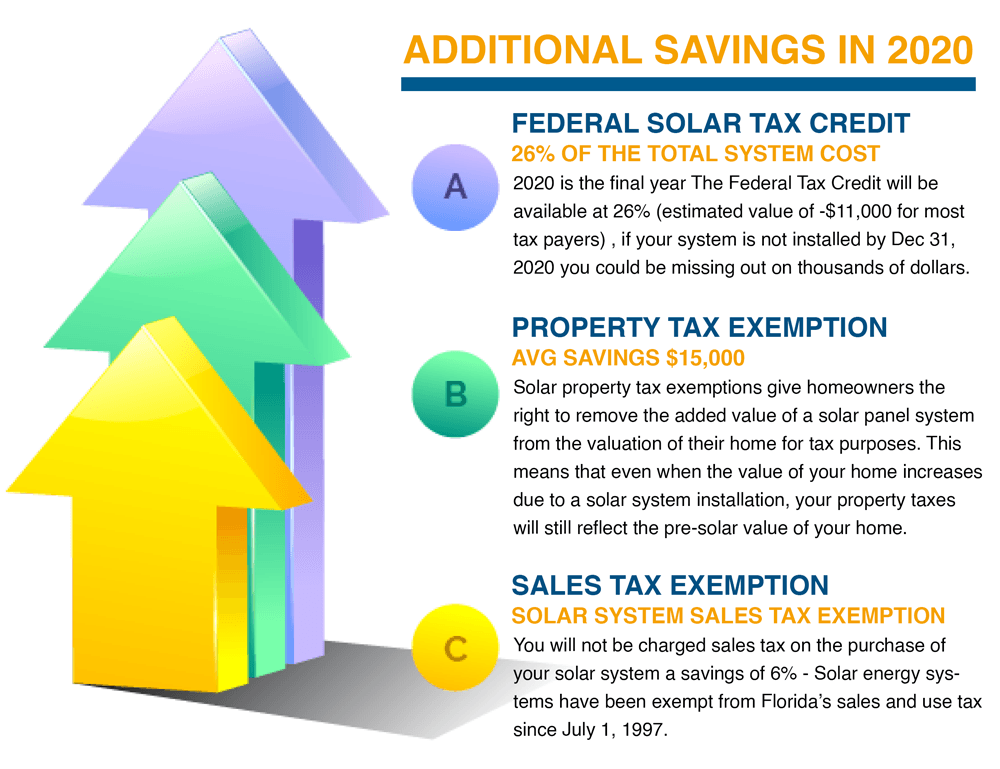

Industry experts estimate a total of 27 gigawatts of solar energy had already been installed in the us by 2015 and they predict we will have nearly 100 gw total by the end of 2020. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation. The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. This includes the value of parts and contractor fees for the installation.

The history of the solar investment tax credit. Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s. Right now the solar investment tax credit itc is worth 26 of your total system cost. In this case the amount you spend contributing to the cost of the solar pv system would be the amount you would use to calculate your tax credit.

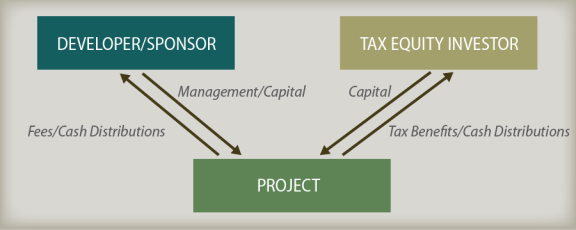

If you are grid tied or participate in net metering the power generated at your facility is placed as a credit to your energy bill. The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states. A cash purchase has benefits like using the investment tax credit and depreciation benefits of solar but not everyone has the ability to buy solar panels with cash upfront or use a lender. Tax credit if they contribute to the costs of an eligible solar pv system.

_540_449_80.jpg)