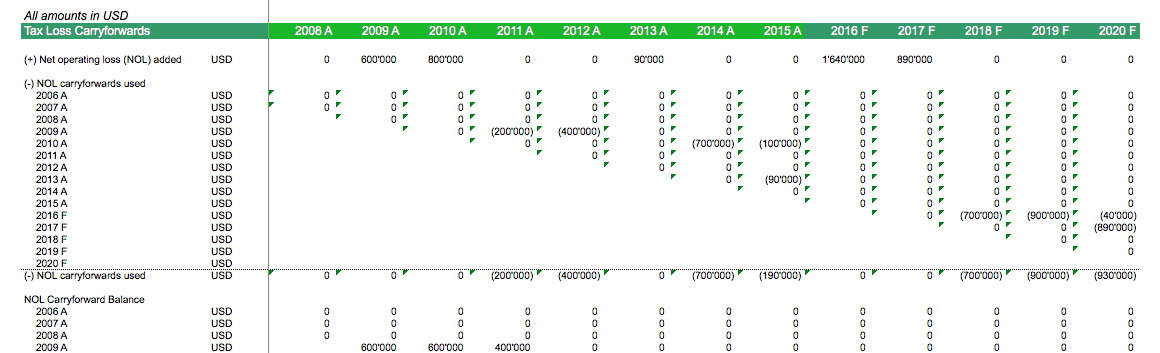

Solar Energy Credit Carryforward

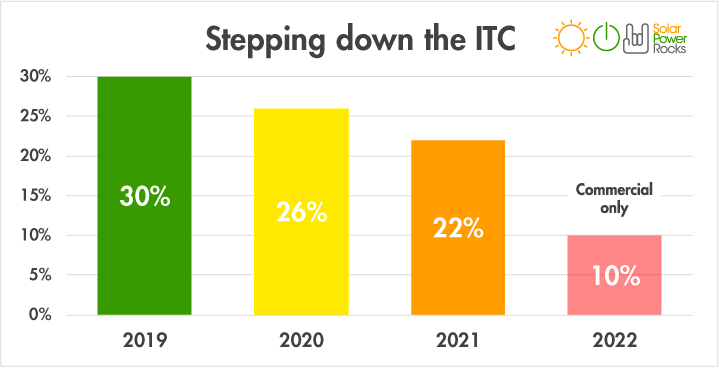

The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states.

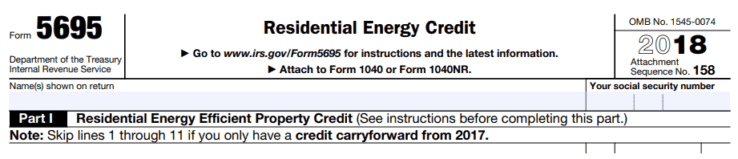

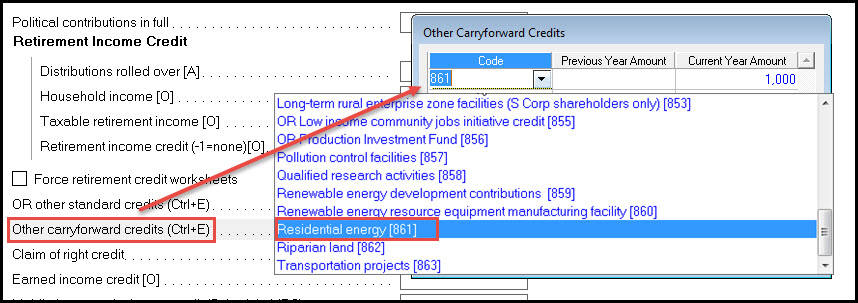

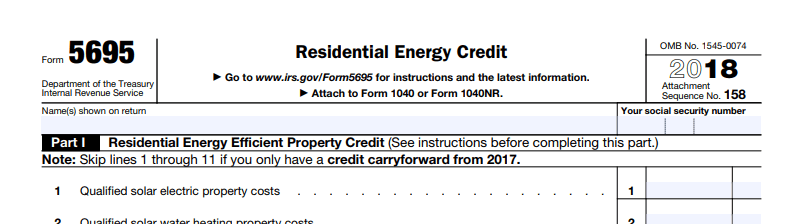

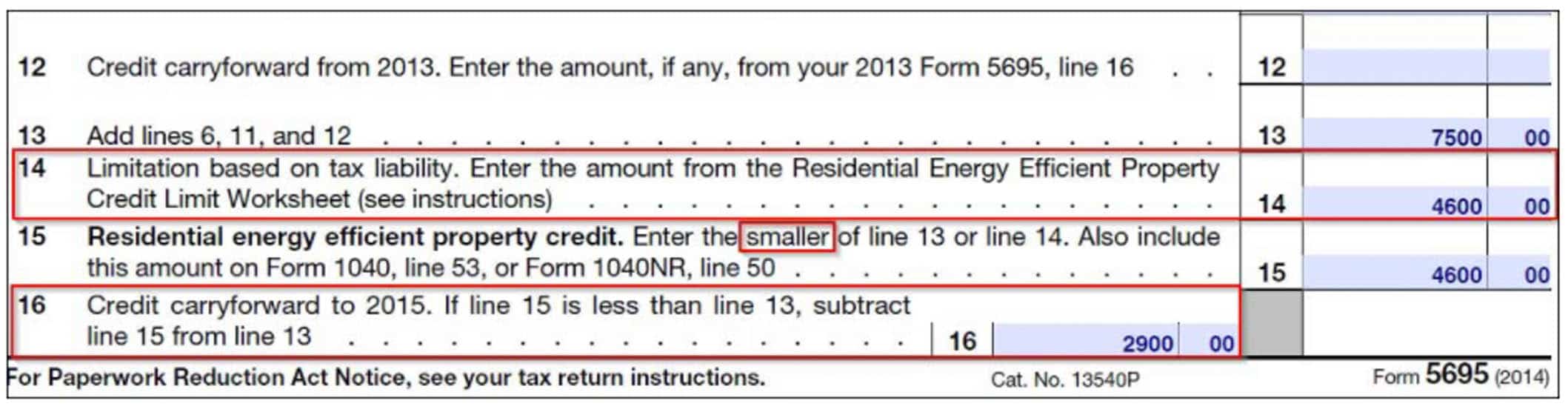

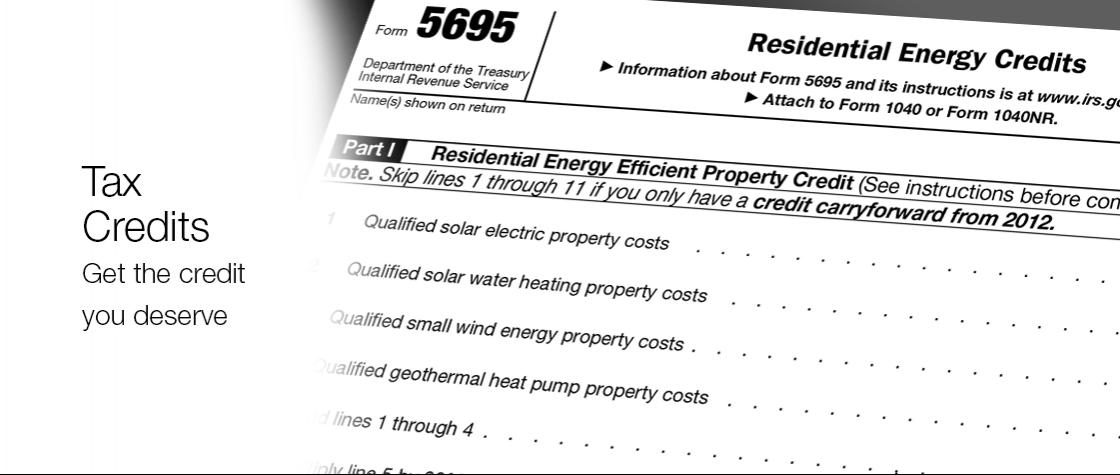

Solar energy credit carryforward. If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation. Yes the unused credit will carry forward to future years if you tax liability limits the amount this year. Add your renewable energy credit information to your typical form 1040. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

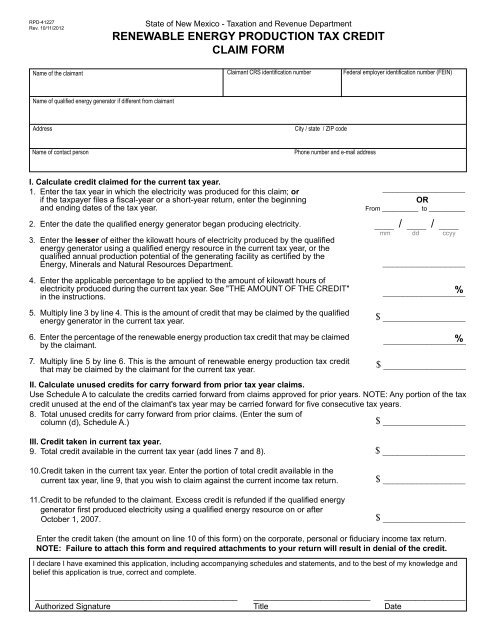

The residential energy credits are. Filing requirements for solar credits. Complete irs form 5695 to add up your renewable energy credits click the link for a step by step walkthrough on filing your tax forms. We hope this serves as a good introduction to the federal solar tax credit and helps you navigate the research process.

However it is not yet clear whether you can carry unused credits to years after the solar credit expires. You calculate the credit on the form and then enter the result on your 1040. To claim the credit you must file irs form 5695 as part of your tax return.