Solar Energy Credit Arizona

Residential arizona solar tax credit.

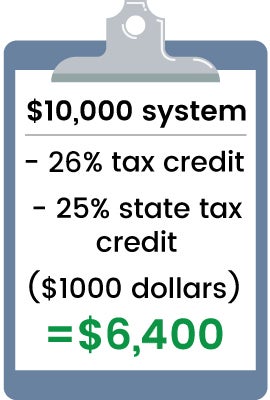

Solar energy credit arizona. Arizona home solar system owners are eligible for a credit worth 25 of their system cost or up to 1 000 whichever is less. Form year form instructions published. This credit offers 25 off the gross cost of the system up to a maximum credit of 1 000. Credit for solar energy devices.

This incentive is an arizona personal tax credit. The most significant solar rebate offered in arizona is the credit for solar energy devices from the arizona department of revenue. The renewable energy production tax credit is for a qualified energy generator that has at least 5 megawatts generating capacity and is not for a residential application. Thanks to the solar equipment sales tax exemption you are free from the burden.

A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayer s residence located in arizona. Arizona residential solar and wind energy systems tax credit. The credit amount allowed against the taxpayer s personal income tax is 25 of the cost of the system with a 1 000 maximum regardless of the number of energy devices installed. Equipment and property tax exemptions.

The residential arizona solar tax credit reimburses you 25 percent of the cost of your solar panels up to 1 000 right off of your personal income tax in the year you install the system. No preapproval is required for an individual income tax credit for a residential solar energy device tax credit that is claimed on form 310. Residential solar energy credit. Energy equipment property tax exemption.